IRS Instruction 1065 - Schedule K-1 2024-2026 free printable template

Instructions and Help about IRS Instruction 1065 - Schedule K-1

How to edit IRS Instruction 1065 - Schedule K-1

How to fill out IRS Instruction 1065 - Schedule K-1

Latest updates to IRS Instruction 1065 - Schedule K-1

All You Need to Know About IRS Instruction 1065 - Schedule K-1

What is IRS Instruction 1065 - Schedule K-1?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

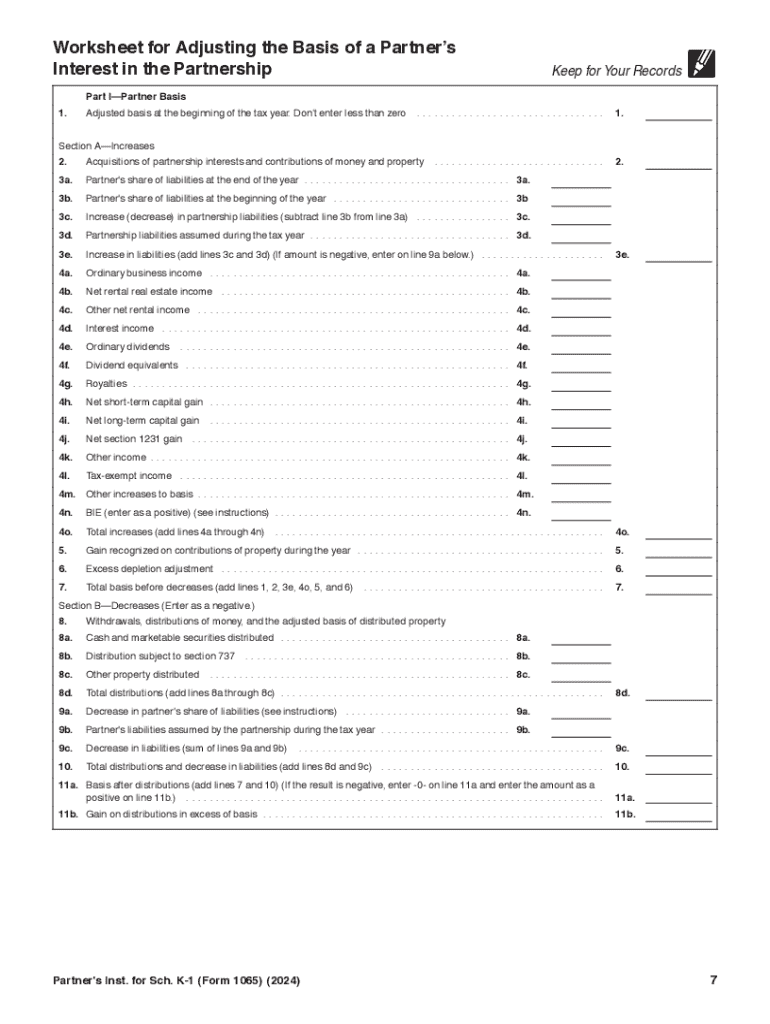

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS Instruction 1065 - Schedule K-1

What should I do if I realize there's a mistake on my IRS Instruction 1065 - Schedule K-1 after submission?

If you spot an error on your IRS Instruction 1065 - Schedule K-1 after it's filed, you need to file an amended return. This involves completing the appropriate forms to correct the mistakes. Additionally, it's crucial to provide explanations for the amendments to avoid potential penalties or issues during audits.

How can I verify the receipt and processing status of my IRS Instruction 1065 - Schedule K-1?

To check the status of your IRS Instruction 1065 - Schedule K-1, you can use the IRS 'Where's My Refund?' tool available on their website, which allows you to track your submission. It's also helpful to keep a record of submission confirmations, as these can facilitate inquiries regarding processing.

What are some common errors I should avoid when dealing with IRS Instruction 1065 - Schedule K-1?

Common mistakes when handling IRS Instruction 1065 - Schedule K-1 include incorrect Tax Identification Numbers (TIN), failing to report all income, and not properly verifying partner details. Double-checking your entries before submission can help minimize such errors.

What should I know about using e-signatures for IRS Instruction 1065 - Schedule K-1?

E-signatures can be accepted for IRS Instruction 1065 - Schedule K-1 under certain conditions. Ensure that your e-signature complies with IRS guidelines; this helps maintain document integrity and legality. It’s vital to retain e-signed documents securely to ensure compliance with record retention requirements.

How do service fees for e-filing affect the submission of IRS Instruction 1065 - Schedule K-1?

When planning to e-file your IRS Instruction 1065 - Schedule K-1, be aware that service fees may apply, which vary depending on the platform you choose. Additionally, if your submission encounters rejection, these fees can impact your overall filing costs, so it's important to consider fee structures before proceeding with e-filing.

See what our users say